Lead Interview with Daisy Cooper MP

Daisy Cooper MP Daisy Cooper is the Liberal Democrat MP for St Albans, and has been an MP continuously since 12 December 2019. She currently undertakes

Cookies are Dead – How to Boss Your Social Media Ads Post-iOS 14

Cookies have been a fundamental tool for marketers for years. So much so, that digital marketers have become reliant on them, not only from a

WHAT IS THE BEST CLOUD ACCOUNTING SOFTWARE?

There are so many options available when it comes to Cloud Accounting software and platforms and deciding what’s best for your business can be confusing.

DELAYS, EXCUSES, AND TERMINATION OF CONTRACTS

When suppliers fail to meet their obligations, contract terms hold the key to your options What can you do when a contract has not been

Mobilise and protect your business with Croft Communications

By mobilising your business, you can reduce overhead, become more flexible and establish business continuity protocols to see you through any crisis. If you haven’t

Detect & Protect with Croft’s Thermal Imaging Solution

COVID-19 has dealt a devastating blow to businesses in every sector. For some, the lockdown was too damaging to survive, whereas others are suffering as

The Future of Remote Working: Harnessing the Power of Unified Communications

As companies embrace the idea of flexibility in their workforce, co-working spaces and hot desking have become increasingly popular. The traditional office-based 9 to 5

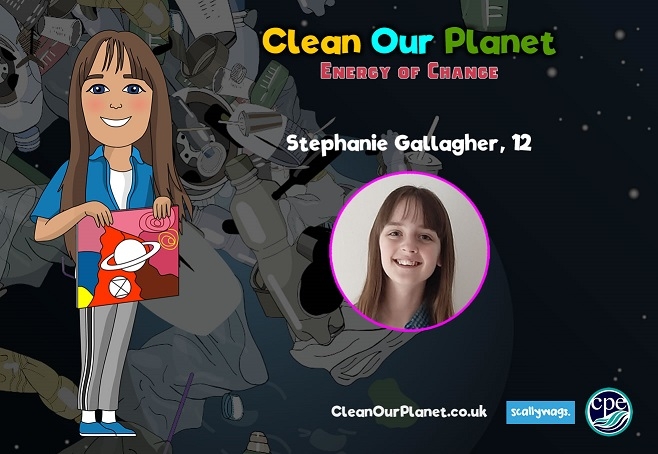

Local girl, Stephanie Gallagher, From Hemel Hempstead, Wins Nationwide Competition To Be Lead-voice In New Animated Series About Cleaning-up Our Planet.

A nationwide competition to find the voice of the lead character for a new animated series has today announced that local school-girl, Stephanie Gallagher, from

COVID-19 Pandemic Causing Poor Mental Health In Third Of Children

More than three million children in the UK could be struggling with poor mental health due to the COVID-19 pandemic, according to new research from

Reality Of Drone Delivery Unveiled – Myths, Mistakes And The Way Forward Revealed

The UK Government’s new initiative to find a fast way to deliver medicines and supplies via air drones, in response to the Covid-19 pandemic, was